Delving into How to Manage Business Finances with Accounting Software, one quickly recognizes the transformative power of technology in streamlining financial operations. In today’s fast-paced business environment, accounting software stands as a critical tool for enhancing financial accuracy and efficiency. By automating tedious tasks and providing real-time insights, businesses can make more informed decisions, ultimately driving growth and profitability.

Furthermore, the benefits extend beyond mere number crunching; successful companies have demonstrated that the right accounting software can reduce errors and improve overall financial management. From tracking income and expenses to generating detailed reports, these tools are designed to simplify complex tasks and support strategic planning.

Importance of Accounting Software in Business Finances

In today’s fast-paced business environment, managing finances efficiently is crucial for success. Accounting software plays a vital role in streamlining financial management processes, enabling businesses to maintain accurate records, analyze financial data, and make informed decisions. The transition from traditional bookkeeping methods to advanced accounting software has transformed how companies handle their finances, offering numerous advantages that contribute to improved organizational efficiency.

The implementation of accounting software significantly enhances financial accuracy and minimizes the risk of errors common with manual bookkeeping. Automated calculations reduce human error, ensuring that financial reports reflect true and reliable data. Furthermore, these systems enable real-time tracking of income and expenses, providing management with up-to-date information critical for decision-making. For instance, businesses using accounting software can generate accurate profit-and-loss statements, balance sheets, and cash flow statements with just a few clicks.

This level of precision not only saves time but also builds trust with stakeholders, including investors and auditors.

Benefits of Using Accounting Software

The advantages of adopting accounting software for managing business finances are extensive. Here are some key benefits that underscore the importance of this technology:

- Time Efficiency: Accounting software automates repetitive tasks such as invoice generation and transaction recording, significantly reducing the time spent on bookkeeping. Businesses can allocate resources to more strategic areas instead of manual entries.

- Cost Savings: By minimizing errors and streamlining processes, businesses can save on costs associated with financial discrepancies and labor-intensive manual record-keeping.

- Scalability: Accounting software can grow alongside a business, easily accommodating increased transaction volumes or additional users as the company expands without significant overhead costs.

- Enhanced Financial Analysis: With features such as dashboards and analytics, accounting software provides insights into financial performance, helping businesses identify trends and make data-driven decisions.

- Regulatory Compliance: Many accounting software solutions include built-in compliance checks to help businesses adhere to regulatory requirements, reducing the risk of fines or other penalties.

Several successful companies have exemplified the benefits of using accounting software. For instance, the popular e-commerce platform Shopify utilizes accounting software integrations to efficiently manage financial transactions and reporting. Moreover, small businesses like the coffee chain Blue Bottle Coffee have leveraged such technology to streamline their financial operations, allowing them to focus more on customer experience and product quality rather than being bogged down by tax preparation and bookkeeping tasks.

These examples illustrate not only the versatility of accounting software across various business sizes but also its profound impact on operational efficiency and strategic management.

Features to Look for in Accounting Software

Choosing the right accounting software is pivotal for the effective management of business finances. The features integrated into accounting software can greatly influence the efficiency and accuracy of financial operations. Understanding which characteristics are essential can help businesses streamline their processes, enhance financial reporting, and ensure compliance with regulations.A user-friendly interface is paramount in accounting software. It allows users, regardless of their technical expertise, to navigate the system efficiently.

Accessibility is equally important; in today’s fast-paced business environment, being able to access financial data from anywhere, at any time, through various devices can significantly enhance decision-making and operational agility.

Essential Features in Accounting Software

When selecting accounting software, it is vital to consider features that align with the specific needs of your business. Various functionalities can enhance financial management, and these include:

- Automated Invoicing: This feature streamlines the billing process by automatically generating invoices based on sales data, reducing human error and saving time.

- Expense Tracking: Effective software should offer tools for tracking expenses in real-time, allowing businesses to monitor spending patterns and budget more accurately.

- Financial Reporting: Comprehensive reporting capabilities enable businesses to generate detailed financial statements, such as profit and loss statements, balance sheets, and cash flow statements, aiding in strategic planning.

- Tax Compliance: The software should assist in calculating taxes owed and generating necessary tax forms, ensuring compliance with federal and state regulations.

- Multi-Currency Support: For businesses operating internationally, the ability to handle multiple currencies can facilitate smoother transactions and accurate financial reporting.

- Integration Capabilities: The software should seamlessly integrate with other business tools, such as customer relationship management (CRM) systems, e-commerce platforms, and payroll solutions, to enhance overall efficiency.

The significance of a user-friendly interface cannot be overstated. A clean layout, intuitive navigation, and easily accessible help resources can mitigate the learning curve often associated with new software implementations. Moreover, software accessibility on mobile devices ensures that business owners and financial managers can stay connected with their financial data, empowering them to make informed decisions on the go.

Comparison of Accounting Software Options

Different accounting software options in the market vary significantly in features and pricing. Businesses should conduct thorough research to find the right fit. Key players include QuickBooks, Xero, and FreshBooks, among others.

| Software | Key Features | Pricing |

|---|---|---|

| QuickBooks | Automated invoicing, tax compliance, financial reporting | Starts at $25/month |

| Xero | Expense tracking, multi-currency support, integrations | Starts at $11/month |

| FreshBooks | User-friendly interface, automated billing, time tracking | Starts at $15/month |

Each of these options comes with unique strengths tailored to different business needs. For instance, QuickBooks is renowned for its extensive reporting capabilities, while Xero offers superior multi-currency support and integrations. FreshBooks stands out for its user-friendly design and focus on service-oriented businesses. Businesses should evaluate these features against their specific requirements and budget constraints to make an informed decision.

“Selecting the right accounting software can lead to streamlined operations, enhanced financial visibility, and ultimately, better business performance.”

Setting Up Accounting Software

To effectively manage business finances, setting up accounting software is a crucial step that requires careful planning and execution. This process not only involves the installation of the software but also necessitates the organization of financial data and operational procedures to ensure a smooth transition. A well-structured setup can significantly enhance the efficiency of financial management and reporting.The setup process can be broken down into detailed steps that guide businesses through the initial configuration of their accounting software.

It is imperative to gather all necessary information and documentation beforehand to facilitate a seamless transition. Below, we Artikel the essential steps and best practices for setting up accounting software.

Steps for Setting Up Accounting Software

1. Choose the Right Software

Evaluate different accounting software options based on your business size, industry, budget, and specific needs. Consider factors such as user-friendliness, scalability, and technical support.

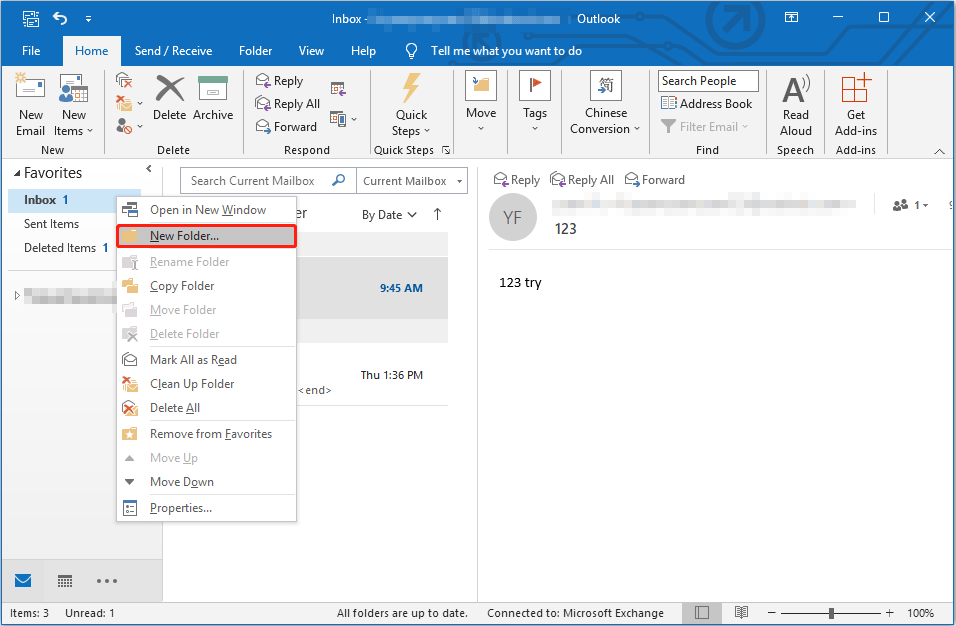

2. Create a User Account

After purchasing or subscribing to the software, create your user account. Follow the prompts to set up your profile and choose a secure password to protect your financial information.

3. Configure Company Settings

Input essential company information such as business name, address, contact details, and tax identification number. This ensures that all financial reports and documents are accurately branded.

4. Set Up Chart of Accounts

Develop a chart of accounts that reflects your business structure and financial activities. This categorization is crucial for organizing transactions and generating relevant financial reports.

5. Integrate Bank Accounts

Link your business bank accounts and payment processors to the software for automated transaction import and reconciliation. This streamlines your financial tracking and helps maintain accurate records.

6. Input Historical Data

If you are transitioning from a manual system, enter historical data that will be relevant for future reports. This may include prior year revenues, expenses, and outstanding invoices.

7. Configure User Permissions

If multiple users will access the accounting software, set permissions to control what each user can view or edit. This helps maintain data integrity and confidentiality.

8. Test the System

Before going live with the software, conduct a thorough test run. Input sample transactions and generate reports to ensure the system operates as expected.

Required Information and Documentation Checklist

Gathering the necessary information will facilitate a smooth setup process. Below is a checklist of required documentation and information:

- Business registration details

- Tax identification number

- List of all bank accounts and payment processors

- Historical financial data (e.g., prior year income statements and balance sheets)

- Current vendor and customer lists

- Chart of accounts structure

- Employee payroll information (if applicable)

Best Practices for Data Migration

Transitioning from manual systems to accounting software requires meticulous planning to ensure accuracy and completeness of data. The following best practices can help you achieve successful data migration:

1. Thorough Data Review

Before migrating data, conduct a comprehensive review of the existing records. Identify any discrepancies or outdated information that need to be corrected.

2. Use Import Tools

Many accounting software options provide import tools or templates for transferring data. Utilize these features to minimize the risk of data entry errors.

3. Perform a Trial Migration

Execute a trial migration with a small subset of data to evaluate the process and identify potential issues. This trial will help refine your approach before the full migration.

4. Validate Data Post-Migration

After migrating all data, compare the new software records with the original documents. Verify that all entries are accurate and complete.

5. Seek Professional Assistance

If the data migration process seems overwhelming, consider enlisting the help of an accounting professional or a software consultant to ensure a successful transition.By following these detailed steps and best practices, businesses can effectively set up accounting software, resulting in improved financial oversight and management.

Managing Business Finances with Accounting Software

Effective management of business finances is crucial for sustainable growth and operational success. Accounting software serves as a vital tool for tracking financial health, ensuring accuracy in bookkeeping, and facilitating informed decision-making. This section delves into the practical aspects of utilizing accounting software to manage business finances efficiently.

Tracking Income and Expenses

Tracking income and expenses accurately is fundamental for any business’s financial management. Accounting software automates this process, simplifying the collection and organization of financial data. Users can categorize transactions, which enhances visibility into revenue streams and expense patterns.To effectively track income and expenses using accounting software:

- Establish clear categories for income and expenses, such as sales revenue, operating costs, and overhead. This categorization allows for better analysis and insights.

- Utilize the software’s integration capabilities to connect with bank accounts and payment processors. This integration allows for automatic updates and reduces manual entry errors.

- Regularly input transactions or sync data from connected accounts to maintain up-to-date financial records. Consistency in data entry ensures a clear picture of financial health.

Generating Financial Reports and Statements

Creating financial reports and statements is an essential feature of accounting software, providing insights into a business’s financial performance. These reports help stakeholders make informed decisions based on real-time data.The process of generating financial reports typically involves the following steps:

- Select the type of report needed, such as income statements, balance sheets, or cash flow statements, based on the specific financial analysis required.

- Utilize built-in templates offered by the software for standardized reporting, ensuring compliance with accounting principles and practices.

- Customize the reporting period and parameters to reflect specific time frames or financial scenarios, enabling focused analysis.

- Review and analyze the generated reports, noting any significant trends or discrepancies that may require further investigation.

Reconciling Bank Statements

Reconciling bank statements with accounting software is a critical process ensuring accuracy in financial records. This step helps identify any discrepancies between the business’s financial records and the bank’s records, such as missed transactions or data entry errors.The reconciliation process can be Artikeld as follows:

- Access the bank reconciliation feature within the accounting software, selecting the appropriate bank account to reconcile.

- Import the latest bank statement electronically, ensuring that the software can automatically match transactions recorded in the accounting system with those on the bank statement.

- Manually review any unmatched transactions, making necessary adjustments in the accounting records to reflect accurate financial data.

- Finalize the reconciliation by confirming that the balances match, which verifies the integrity of financial information.

Regular bank reconciliations enhance financial accuracy and detect potential fraud or errors early on.

Integrating Accounting Software with Other Business Tools

Integrating accounting software with other business tools is essential for maximizing productivity and operational efficiency. This integration creates a seamless flow of information across various platforms, reducing manual data entry and errors, while providing a comprehensive view of a business’s financial status. Businesses can leverage this interconnectedness to streamline their processes and improve decision-making.Integrating accounting software can significantly enhance business efficiency by automating workflows and ensuring that data is synchronized across systems.

This results in real-time insights and saves valuable time that can be better spent on strategic activities rather than administrative tasks. Various tools can complement accounting software, ranging from Customer Relationship Management (CRM) systems to inventory management solutions.

Common Business Tools for Integration

A range of business tools can be integrated with accounting software to enrich functionality and improve collaboration. The following are key tools often integrated:

- Customer Relationship Management (CRM) Software: Tools like Salesforce or HubSpot can provide valuable customer data that enhances financial reporting and forecasting.

- Project Management Software: Applications such as Asana or Trello allow businesses to track project costs and allocate resources efficiently, feeding data directly into accounting systems.

- Payroll Systems: Software like Gusto or ADP automates payroll calculations and tax deductions, ensuring accurate financial records and compliance.

- Inventory Management Tools: Solutions like TradeGecko or Fishbowl keep track of stock levels and sales, impacting financial statements and cash flow forecasts.

- E-commerce Platforms: Platforms such as Shopify and WooCommerce can be integrated to streamline sales data directly into accounting systems for accurate revenue tracking.

The integration of these tools not only streamlines workflows but also enhances data accuracy, providing a holistic view of the business’s financial health.

Software Ecosystems That Work Well Together

Several software ecosystems demonstrate effective integrations that enhance business performance. Notable examples include:

- QuickBooks with Shopify: This combination allows for automatic syncing of sales data from Shopify into QuickBooks, facilitating accurate bookkeeping.

- Xero with HubSpot: This integration enables automatic updates of customer data and financial transactions, improving customer relationship management.

- FreshBooks with PayPal: This pairing helps businesses to seamlessly manage invoices and receive payments directly through the accounting system.

- Sage with Microsoft Office: Integrating Sage with Office applications allows for enhanced reporting capabilities through Excel, enabling deeper financial analysis.

- Zoho Books with Zoho CRM: This integration provides a unified view of customer interactions and financials, improving overall business insights and strategies.

Integrating these tools within a cohesive ecosystem allows businesses to harness the full power of their data, driving efficiency and providing critical insights for strategic decision-making.

“Effective integration of accounting software with other business tools enables seamless data flow, enhancing accuracy and efficiency across operations.”

Training and Support for Accounting Software Users

Proper training and support are essential components for the effective use of accounting software within any business. As businesses increasingly rely on technology to manage their financial operations, ensuring that employees are equipped with the necessary skills and knowledge becomes imperative. Well-trained staff can leverage the software’s capabilities to its fullest, leading to improved accuracy in financial reporting and decision-making.To facilitate the successful adoption of accounting software, various training methods can be employed.

Each method has its unique advantages and can cater to different learning preferences among employees.

Training Methods for Employees

Implementing a comprehensive training program ensures that all users are well-versed in the functionalities of the accounting software. The following methods are commonly utilized:

- Workshops: In-person or virtual workshops offer hands-on training sessions where employees can engage directly with the software. These sessions typically incorporate real-world scenarios, allowing users to practice tasks in a guided environment.

- Webinars: Webinars provide a flexible training option, allowing employees to learn from anywhere. They can be recorded for later access, enabling staff to revisit training content as needed.

- Documentation: Comprehensive user manuals and online resources are invaluable for ongoing reference. Documentation should include step-by-step guides, FAQs, and troubleshooting tips to assist users in navigating common challenges.

- Peer Training: Encouraging experienced users to mentor less experienced colleagues fosters a collaborative learning environment. This method promotes knowledge sharing and supports team cohesion.

Ongoing support is as crucial as initial training. Businesses should establish resources for continuous assistance and troubleshooting.

Resources for Ongoing Support

Having access to reliable support resources enhances user experience and addresses issues promptly. Consider the following options for sustained support:

- Help Desks: A dedicated help desk can provide immediate assistance for technical issues, ensuring that any disruptions to the accounting process are minimized.

- Online Forums: Community forums allow users to connect, share experiences, and seek advice from other users and experts. These platforms can be beneficial for problem-solving and best practice sharing.

- Regular Updates: Keeping the software updated is essential for functionality and security. Regular updates can also include new features, which should be communicated effectively to users.

- Feedback Mechanisms: Establishing a feedback system enables users to report issues and suggest improvements. This creates a user-centered approach to software management.

Implementing these training methods and support resources not only enhances employee proficiency with accounting software but also contributes to overall business efficiency and financial success.

Common Challenges and Solutions in Using Accounting Software

While accounting software can significantly enhance the management of business finances, it is not without its challenges. Many businesses encounter various issues when implementing and utilizing accounting software, often hindering the full benefits of these tools. Understanding these challenges and proactively developing solutions is crucial for maximizing the efficiency and effectiveness of accounting practices.Businesses may face several common challenges when using accounting software.

These challenges can stem from user error, software limitations, or integration difficulties. Addressing these issues with effective strategies can ensure smoother operations and better financial management.

User Error and Training Deficiencies

One of the most prevalent challenges is user error, often due to inadequate training. Employees may struggle with software functionalities, leading to inaccuracies in financial reports. Training programs are essential in mitigating this challenge. Providing comprehensive training sessions tailored to various user skill levels can enhance user proficiency.

Solution Strategies

Implement regular training workshops to keep users updated on software features.

Develop user manuals and quick reference guides to assist employees during use.

Utilize online tutorials or webinars that cater to different learning styles.

Integration with Existing Systems

Another significant challenge is the integration of accounting software with other existing business systems, such as Customer Relationship Management (CRM) or inventory management tools. Incompatibilities can result in data silos, leading to inefficiencies and errors.

Solution Strategies

Conduct thorough research before selecting accounting software to ensure compatibility with current systems.

Engage with software vendors who offer integration support and consultation.

Utilize middleware solutions that can facilitate data exchange between disparate systems.

Data Security and Compliance Issues

Data security and compliance with financial regulations are critical concerns for businesses utilizing accounting software. Cybersecurity threats can lead to data breaches, while non-compliance with regulations can result in hefty fines.

Solution Strategies

Invest in robust cybersecurity measures, including firewalls and encryption.

Regularly update software to incorporate the latest security patches.

Consult legal and compliance experts to ensure adherence to financial regulations.

Case Studies of Successful Navigation of Common Issues

Several businesses have successfully navigated these common challenges through strategic planning and implementation.

Case Study

ABC Manufacturing ABC Manufacturing faced significant user error due to a lack of training. By implementing a comprehensive training program that included both in-person and online resources, they reduced user-related errors by 30% over six months. This approach ensured employees were confident and competent in using the software.

Case Study

XYZ Retail XYZ Retail struggled with integration between their accounting software and inventory management system. By collaborating with their software provider to customize integration solutions, they streamlined their operations. As a result, they achieved a 25% improvement in reporting accuracy and a decrease in inventory discrepancies.By recognizing these challenges and employing targeted solutions, businesses can enhance their experience with accounting software, leading to improved financial management and operational efficiency.

Future Trends in Accounting Software

The landscape of accounting software is rapidly evolving, driven by advancements in technology and changing business needs. As organizations seek greater efficiency and accuracy in financial management, emerging trends are shaping the future of accounting software. Understanding these trends is crucial for businesses aiming to stay competitive and leverage the full potential of modern accounting solutions.The integration of artificial intelligence (AI) and automation is significantly transforming the accounting software industry.

These technologies enhance data processing capabilities, reduce human error, and streamline accounting tasks. Businesses that embrace these innovations can expect to see improved efficiency, accuracy, and insights into their financial operations.

Emerging Trends in Accounting Software Technology

Several key trends are expected to impact accounting software in the coming years. Organizations should consider the following developments as they prepare for the future:

- Artificial Intelligence: AI tools are becoming increasingly prevalent, enabling predictive analytics, automated data entry, and enhanced decision-making processes. For instance, AI can analyze past financial data to forecast future trends, helping businesses to strategize effectively.

- Cloud Computing: Cloud-based accounting solutions offer flexibility and accessibility, allowing users to access financial information from anywhere. This is particularly beneficial for remote work scenarios and collaboration among teams spread across different locations.

- Integration with Other Technologies: Accounting software is increasingly being integrated with other business tools, such as CRM systems and ERP solutions. This seamless integration facilitates real-time data sharing and enhances overall business intelligence.

- Enhanced Cybersecurity Measures: As cyber threats continue to rise, accounting software providers are investing in stronger security protocols. Multi-factor authentication and encryption are becoming standard features to protect sensitive financial data.

- Mobile Functionality: The demand for mobile-friendly accounting software is growing as businesses seek to enable financial management on-the-go. Applications that allow for mobile invoicing, expense tracking, and real-time reporting are gaining traction.

Businesses can prepare for these changes by investing in training for their employees, staying informed about technological advancements, and evaluating accounting software options that incorporate these emerging trends. Engaging with software vendors to understand their roadmap for future developments can also provide valuable insights into how organizations can align their strategies with technological advancements.

“The future of accounting is not just in numbers; it’s in the technology that drives decision-making.”

Conclusion

In conclusion, the integration of accounting software into business practices not only optimizes financial management but also prepares companies for future challenges and opportunities. As we have explored, understanding the essential features, proper setup, and ongoing support is vital for maximizing the benefits of these tools. By embracing technology, businesses can enhance efficiency, reduce errors, and ultimately achieve greater financial success.